The FIRE Movement has taken personal finance communities by storm, and for good reason. Canadians are one of the most indebted populations in the world and debt levels may continue to rise. Whether this is due to the incredible increases in real estate prices or a general love for consumerism, the current financial prospects of the average working Canadian make early retirement seem like a pipe dream.

But what if it wasn’t?

Every Canadian above the age of 18 has access to a relatively unknown account called the Tax-Free Savings Account (or TFSA for short). This account allows Canadians to contribute after tax income up to their annual contribution limit, invest those savings within the TFSA and have the capital gain or dividend income earned be tax-free.

So what does the TFSA have to do with FIRE? The FIRE movement prioritizes relatively-extreme saving for retirement, and the TFSA allows for tax-free investment income. This makes the TFSA a great tool to help reach your retirement goals.

Contents

- What is FIRE?

- The TFSA Explained

- How to Calculate Your FI Number

- How the TFSA Factors into FIRE

- Conclusion & Key Takeaway

What is FIRE?

FIRE stands for Financial Independence, Retire Early. The movement is based on figuring out your Financial Independence (FI) number, and striving towards having that number invested to achieve early retirement.

The Power of the TFSA

The TFSA (Tax-Free Savings Account), is an amazing savings tool for Canadians. As previous mentioned, income earned within the TFSA is tax-free (with the exception of certain investments). For any individual that turned 18 before 2009, the contribution room is currently $69,500 total (as of publishing in 2020). If you turned 18 in 2020, your limit is $6,000.

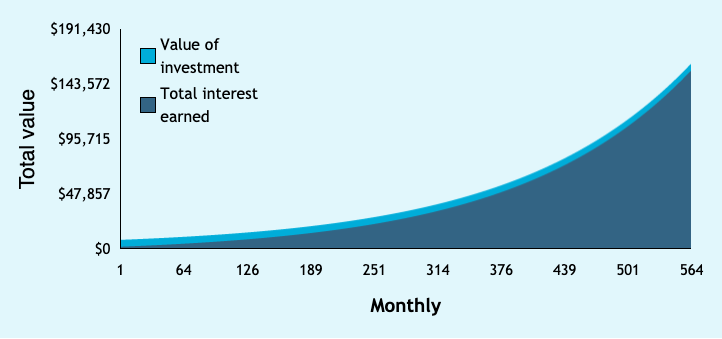

Although this may not sound like much, this is only the contribution limit. The real benefit comes from earned income within the TFSA over time. Let’s take an 18 year old for example, that contributes his or her first $6,000 this year into their TFSA and purchases a broad index fund that will yield 7% per year on average.

Scenario #1

To demonstrate the power of compound interest, let’s say that this 18 year old never contributes anything more to their TFSA until retirement at 65. In those 47 years, that initial $6,000 becomes $159,525.02 tax-free!

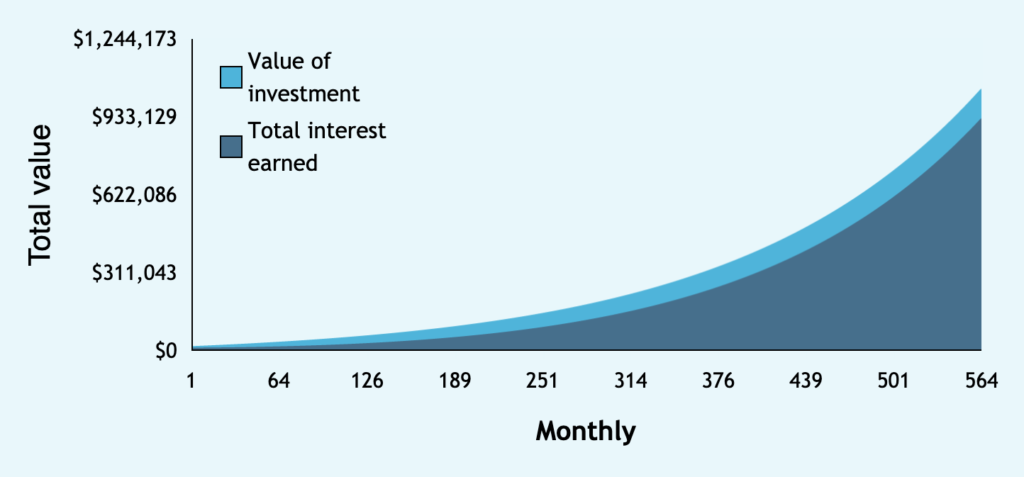

Scenario #2

Let’s say this individual contributes $6,000 at age 18, and then $200 per month until retirement at age 65. This amounts to $118,800 invested. This $118,800 will become $1,036,810.87 in total, tax-free.

The key take-away is that smart saving for retirement also requires time, and preferably lots of it.

FI Number: What is it and How is it Calculated?

How much annual income do you think you will need in retirement? This is a crucial but difficult question to answer – no one knows what the world will look like when your retirement comes around. You have to consider things such as your government pension, your employer pension, health requirements, what kind of lifestyle you’d like to have and more.

To make the calculation simple, let’s say you require $50,000 per year in retirement. This means that your FI number (the amount you need to have invested to have your desired annual income in retirement) is 25 times $50,000.

25 x $50,000 = $1,250,000

The FI Number is $1.25 million in this case. We know this is true by multiplying the FI number by the 4% annual withdrawal rate.

$1,250,000 * 0.04 = $50,000

Simply put, the FI number is your estimated yearly income needs in retirement times 25. If your FI number is invested at an average of 7% annual return, your annual retirement income (4%) can be pulled from your investments without causing your FI number to deplete over the course of retirement.

FIRE With Your TFSA

Now that both FIRE and the TFSA are explained, it may be obvious how they go hand in hand.

Here are two simple facts:

- The TFSA is great for building tax-free nest eggs over the long term.

- To become financially independent, a sizeable nest egg is required to be invested correctly.

The best advantage a TFSA has over a personal investment account is that it allows for tax-free growth. It may not seem like it but these savings can make or break a retirement plan.

If your annual retirement needs equal $50,000 per year and that is the amount you take out of your personal investment account, a sizeable part of that income will be taxed. Any securities kept in a personal account will also have dividends become taxable income, which is another way to have retirement funds be eaten up by taxes. The most ideal situation for a retiree is to have as little taxable income as possible, especially if the individual qualifies for the Canadian Pension Plan and wants to receive the full pension (taxable income may lower it).

If kept in a TFSA, securities are exempt from capital gains tax (the tax on the increase in a security’s value when sold) and from income taxes on dividend payments. A TFSA containing $1.25 million worth of investments can be used for $50,000 per year in income if following FIRE guidelines. That income is tax-free and will not affect pensions.

Conclusion

Any Canadian not taking advantage of their TFSA contribution room is missing out on money that can grow tax-free in stocks, index funds or even GICs. This applies to individuals following FIRE principals and those saving for a traditional retirement. With such a fantastic savings vehicle available, why not take advantage and allow it to do the heavy lifting? This is especially true for young Canadians who still can take advantage of the power of compounded interest.

Key takeaway: A regular contribution to a properly invested TFSA can make or break your retirement. Saving is an important, but seldom taught strategy to a financially independent life, and most individuals don’t realize how to optimize for taxes until it is too late.

To see what your strategy needs to be, use this compounding calculator to see what you need to invest to meet your retirement goals!